The amount of weekly payment of compensation will vary depending on a number of factors which we have summarised below:

Can I claim Weekly Compensation Payments?

Before you can receive weekly payments of compensation you must:

- Have sustained an injury in the course of your employment.

- Have given notice of that injury to your employer within six months of the date of injury.

- A notice of injury may be given orally or in writing.

- The employer must within 24 hours of such notice notify the workers compensation insurer of the injury.

- A written claim form is not necessary.

Once the insurer has been notified of the injury they must, within 7 days, do one of the following:

- Accept provisional liability and commence payment of weekly compensation; or

- Issue a “Reasonable Excuse Notice” outlining the reasons why provisional liability has not been accepted. If a reasonable excuse notice is provided the insurer has a further 21 days to determine whether or not, they will provisionally accept the claim.

- If a “Reasonable Excuse Notice” is provided, then you may be required to complete a written claim form.

How to claim Weekly Compensation Payments?

If you are totally or partially unfit for work and are losing income as a direct result of a workplace injury you have a right to make a claim for weekly payments.

To make a claim for weekly payments you need to attend your General Practitioner (known as the Nominated Treating Doctor) and obtain a WorkCover Certificate of Capacity. This certificate sets out whether you are totally or partially unfit for work. If partially unfit for work, the certificate will detail what restrictions you have in terms of the hours and the type of duties you can perform. The WorkCover Certificate of Capacity needs to be completed and provided to your employer as soon as possible.

If liability for your claim is declined, you need to contact an Accredited Specialist in Personal Injury Law immediately so this can be investigated and if necessary, challenged. If the insurer accepts liability for your claim they will commence weekly payments of compensation. The amount payable for weekly compensation varies depending on the following:

- Whether you are totally or partially unfit for work.

- Whether the employer has suitable work available for you.

- The amount of your pre-injury average weekly earnings.

What does AWE mean?

AWE means the workers pre injury average weekly earnings. Average weekly earnings includes ordinary earnings plus overtime and shift allowance (however overtime and shift allowance is only to be taken into account when determining the AWE for the first 52 weeks).

What Does MAX mean?

MAX is the maximum amount which can be used to calculate pre injury average weekly earnings. At present the maximum amount is $1,999.30 per week. If your pre injury average weekly earnings is more than $1,999.30 the insurer will use $1,999.30 to calculate your entitlements. This amount is increased in April and October each year.

Weekly payments when certified unfit for work

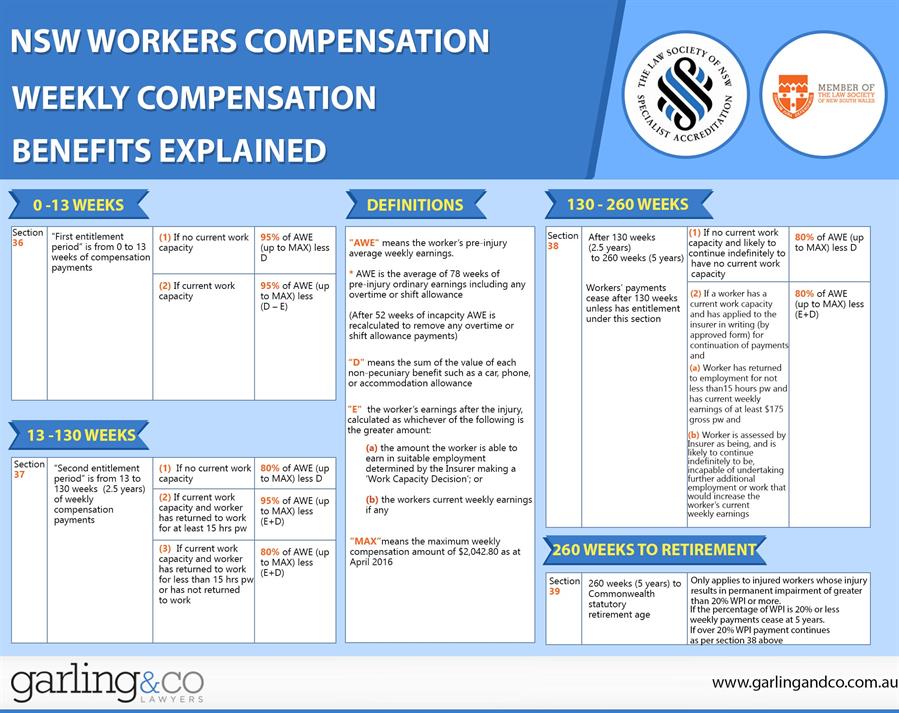

Payments for the first 13 weeks

For the first 13 weeks where you are unfit to work, your weekly payment is based on 95% of your average weekly earnings (AWE) up to a maximum weekly compensation amount (MAX).

Payments from 14 to 130 weeks

From 14 to 130 weeks of weekly compensation where you remain certified unfit for work you are entitled to receive 80% of your AWE (up to the MAX).

Payments from 131 to 260 weeks

Between 131 weeks (2 years) to 260 weeks (5 years) the insurer will conduct a Work Capacity Assessment. If the insurer finds that you have no current work capacity and that this is likely to continue indefinitely, you will receive weekly payments of 80% of your AWE (up to MAX) – D.

To receive ongoing benefits after 130 weeks the worker must request ongoing benefits in writing from the insurer before the end of the 130 week period. The insurer must then undertake a Work Capacity Assessment which must be performed during the last 52 weeks of the period from 14 to 130 weeks.

After 260 weeks (5 years) of weekly payments

Weekly payments of compensation will cease after 5 years unless your level of whole person impairment is greater than 20%. You also must be assessed by the insurer as having no work capacity and likely to continue indefinitely to have no work capacity.

Therefore if you have an assessment of 21% or greater you are entitled to weekly payments of compensation at 80% of the AWE (up to MAX) – D until your commonwealth statutory retirement age. For most people the commonwealth statutory retirement age is now 67.

Weekly payments when certified fit for suitable duties

The amount payable for weekly compensation is different if you are certified fit for suitable duties by your nominated treating doctor or are found by the insurer who undertakes a work capacity assessment as being fit for suitable work.

Payments for the first 13 weeks

For the first 13 weeks your weekly payments are calculated as 95% of AWE (up to MAX) less (E) and (D).

Payments from 14 to 130 weeks

From 14 to 130 weeks where you are certified fit for suitable duties and if you continue to be certified fit for suitable duties and you have not returned to work for at least 15 hours per week, you are entitled to 80% of AWE (up to MAX) less (E) and (D).

If you are fit for suitable duties and you have returned to work for at least 15 hours per week then you are entitled to 95% of AWE (up to MAX) less (E) and (D).

Payments from 131 to 260 weeks

If at 130 weeks you are fit for suitable duties, to receive any weekly compensation you must:

- Have completed an application to continue to receive weekly payments after 130 weeks form and sent it to the insurer.

- You must be working 15 hours or more per week and earning at least $176.00 per week (indexed annually) and have been assessed by the insurer under a Work Capacity Assessment as being likely to continue indefinitely to being capable of undertaking further additional employment or work that would increase your earnings.

If you are fit for suitable duties and are not working 15 hours per week and earning at least $176.00 then your weekly benefits will stop. If you are working at least 15 hours per week and the insurer accepts through the Work Capacity Assessment that you are incapable of undertaking further additional employment then you are entitled to receive 80% of AWE (up to MAX) less (E) and (D).

If your level of whole person impairment is greater than 20%then you receive weekly payments as above even if you are not working 15 hours per week..

Payments after 260 weeks (5 years) of weekly payments

Weekly payments of compensation will cease after 5 years unless your level of impairment is greater than 20%.

Weekly payments are then payable at 80% of your average weekly earnings (up to the MAX) less (E) + (D) until statutory retirement age.

Conclusion

As can be seen from above, the amount of weekly payments of compensation payable under the Act is complex and is determined by whether or not you are unfit for work or fit to undertake suitable employment.

At 130 weeks of compensation, the insurer must have undertaken a Work Capacity Assessment as to whether or not you are fit or unfit for work. This Work Capacity Assessment essentially overrides the WorkCover Medical Certificates you have been obtaining from your nominated treating doctor. After 130 weeks the insurer must determine through the Work Capacity Assessment that you are either unfit for work or only fit for suitable duties and are indefinitely incapable of increasing your hours of work.

Importantly when you have received weekly compensation up to 260 weeks (5 years), all benefits will cease unless you have a whole person impairment of greater than 20%. For the vast majority of workers therefore payments will cease at 130 weeks (2 years) when the insurer conducts a Work Capacity Assessment as most assessments will find that workers can undertake at least 15 hours work per week. If you do not then find employment of at least 15 hours per week, your benefits will cease.

- Complete our free case assessment here.

- Email us at info@garlingandco.com.au

- Give us a call on (02) 8329 9500

For more information on Workplace Compensation Claim Success, read our guide here.